26th August 2019:

It’s not just about Talking the Talk…..

The 56 Degree Insight team are excited to share the results from our survey of 16 iconic Scottish brands - the 2019 56DI Scottish Brands Index survey. This will be an annual survey which adds a Scottish flavour to brand evaluation – a unique addition to the Scottish marketplace. Each week we will examine one of the key metrics of brand success. This week our focus is on awareness, performance and the connection consumers have with each of these brands……

Introduction

The owners and managers of brands often are guilty of a little misconception - that their carefully constructed image of the brand is the reality of what it means to their target audience. However, often, this carefully constructed image is more about what they would like the brand to represent as opposed to what the general public really think. More often than not, consumer perceptions and experiences shape the brand image to a greater extent than the brand itself. Essentially, what consumers are saying about their brand, that is the brand.

And these perceptions are based on brand awareness which has two key components:

Brand recognition

Perceived brand performance

Brand recognition is one of the most important aspects of marketing campaigns, at least initially. Introducing potential customers to a product or service in the right way matters, because just as it is with meeting people — with brand awareness — first impressions count. The extent to which a product is recognised lies with its brand awareness, which can make or break the brand's profitability.

But Brand performance is also vital. This most often comes through either direct or indirect experience of that brand – or by what these consumers have heard from others. It is often seen as more the preserve of Customer Experience programmes than brand health studies; but bluntly, brand measurement and customer experience measurement are more inextricably linked than ever before. That said, it remains a source of recurring surprise when we still see one part of a company undertaking a brand health study while another department conducts a customer experience study – with little or no attempt to link the two together. The customer experience drives so many components – perceptions of the brand, what people say about the brand, loyalty, future purchase etc. – not incorporating this type of analysis within a brand health study is missing a huge trick.

Therefore, when we were deciding on the components of the Scottish Brands Index, we felt that it was vital that Awareness should be a key measure – and should incorporate measures of both levels of Recognition of the Brand and the perceived brand Performance. In many ways, this provides a baseline measure of that brand’s position within consumers’ minds – and a starting point for the brands themselves to form strategies around how they can strengthen the brand.

And linked to awareness – and perceived performance, has to be a measure of Involvement – the emotional connection with a brand which can go from a deep rooted care about the sector or brand itself through to a lack of connection and involvement displayed by ambivalence.

In the Scottish Brands Index analysis which follows, we look at each of these elements of our Scottish brands – recognition, performance and involvement. Our survey was undertaken during June and July 2019 using Kantar’s Scottish Opinion Survey – the only in-home, face-to-face omnibus survey in Scotland, and one that is representative of the Scottish adult population in terms of geography and demographics. Some 2,000 people were interviewed and asked a range of questions about a cross-section of Scottish consumer-facing brands – 16 in total:

To make survey length manageable, around 500 respondents provided their opinions about each brand. As well as being asked to measure each brand on recognition, performance and involvement, respondents were also asked about trust, innovation, likelihood to recommend, the brand’s potential for future success and the extent to which the brands portrayed Scotland in a positive light. We have already examined Trust and Innovation and over the course of the next few weeks we will examine responses to all of these other metrics. This will lead up to the publication of our combined scores for each brand and revealing the leading Scottish brand among the 16 we tested.

Brands were selected carefully; all were consumer-facing, some longer established than others and coverage spanned a range of sectors – transport, food and drink, utilities, financial services and sport. The 16 brands were key players within these sectors but obviously we were unable to cover all brands – however our selected brands represent a good cross-section of different types of brands in the Scottish marketplace.

Not everyone has heard of your brand!

In today’s overcrowded marketplace, it is all too easy for companies and brands to go unnoticed. One of the most effective methods for brands to ensure they are not one of these forgotten businesses is to enhance their business’s overall brand recognition within their target market. Strong, cohesive brands establish trust in consumers, and trust translates to repeat sales and stronger profits. If a brand has low levels of awareness, all of its other strengths around performance, trust, innovation, loyalty will not be seen by large proportions of potential customers.

So, as a starting point in the Scottish Brands Index survey, we established levels of awareness/recognition of each of the 16 brands among the Scottish population.

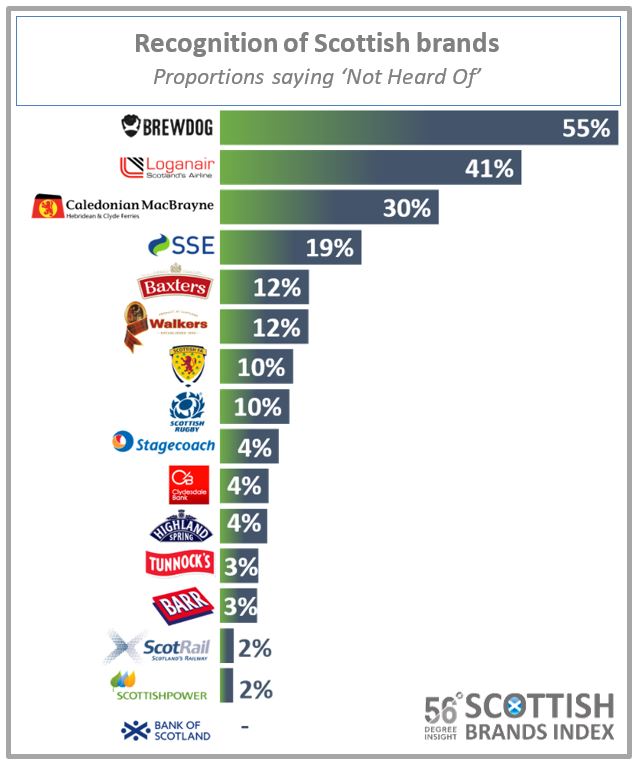

The results may appear somewhat surprising at first: only 7 of the 16 brands are recognised by at least 95% of Scots. Many brands assume that everyone has heard of them – but of course, in a diverse population, that is rarely the case – and in this example, only Bank of Scotland has 100% awareness. That said, brands such as Scotrail, Scottish Power, Tunnocks, AG Barr, Highland Spring and the Clydesdale Bank are effectively ‘household names’ with 95%+ levels of recognition. In the case of AG Barr, given that they are most well known through the iconic Irn Bru product, the high levels of awareness for AG Barr itself is particularly interesting, and probably reflects the consistent description of their key product in all of their marketing activity as ‘Barr’s Irn Bru’.

There is a clutch of brands ‘in the middle’ where awareness levels could certainly be higher and which any brand strategy should address – Stagecoach, the rugby and football governing bodies, Walkers and Baxters all have limited awareness among 1 in 10 Scots adults.

The remaining four brands all have major recognition ‘issues’ among Scots. Perhaps most surprising is SSE which 1 in 5 Scots did not recognise. This perhaps reflects the complex evolution of the SSE brand from its separate ‘Hydro Board’ and ‘Southern Electric’ roots through merger and several name changes. And the reality is that brand recognition in Scotland for SSE is lower than might be expected for one of the Big 6 energy companies and considerably behind its main Scottish competitor, Scottish Power.

Three in ten Scots had not heard of Caledonian MacBrayne, and four in ten were unaware of Loganair. Lower levels of recognition are perhaps less surprising in these cases as they are essentially Scottish regional transport brands much more prevalent in the Highlands and Islands (borne out by much higher levels of recognition in these areas in our survey than in the South and East of Scotland).

BrewDog is the brand with lowest levels of recognition – over half of Scots adults had not heard of the craft beer producer. This is not surprising – it is the newest brand under review and one with a niche target audience, and not surprisingly, awareness levels were highest among younger males. But with the brand’s expansion into the High Street and airports in the form of bars, and supermarkets with its new spirits range as well as its beers, the low levels of awareness of the BrewDog brand must be borne in mind in its expansion and growth strategy. Some basic brand awareness building should be a key part of that strategy.

Perceived Performance is a key building block of Brand Strength

Those aware of each brand were then asked to evaluate each in terms of how they perceived their performance. We decided to take an innovative and pragmatic approach to this question which allowed us to evaluate each brand in terms of perceived performance but also to obtain a measure of involvement / connection with each brand.

To do this, we adapted an approach which has become prevalent in political opinion polling. As individual Political Party leaders in the UK and their personalities have become as important as parties when it comes to voting intentions, opinion polling has had to adapt and place more of a focus on the individuals concerned. A common approach has been to measure politicians by means of a net approval score. For example, in a recent poll conducted by Opinium on 8-9 August 2019, 2,000 GB adults were asked, ‘To what extent do you approve or disapprove of the way Boris Johnson is handling his job as Prime Minister’. This resulted in 40% ‘approval’ and 34% ‘disapproval’ – a net ‘approval rating’ of +6.

We decided to adopt a similar approach to measuring perceived performance of our 16 Scottish brands – ‘How good or bad a job do you think [BRAND] is doing at the moment?’ and respondents were invited to rate each brand on a scale from a ‘Very Good Job’ down to a ‘Very Bad Job’.

And of course, as well as ‘Don’t Know’, we also provided a mid point option of ‘Neither good nor bad’. The questions were only asked of those who recognised the brand, and therefore, the answers to these mid-point questions also provide a proxy measure of involvement/relevance of each brand to the respondent.

We will come back to involvement later, but firstly, let’s examine the perceived performance of each of the 16 brands under review:

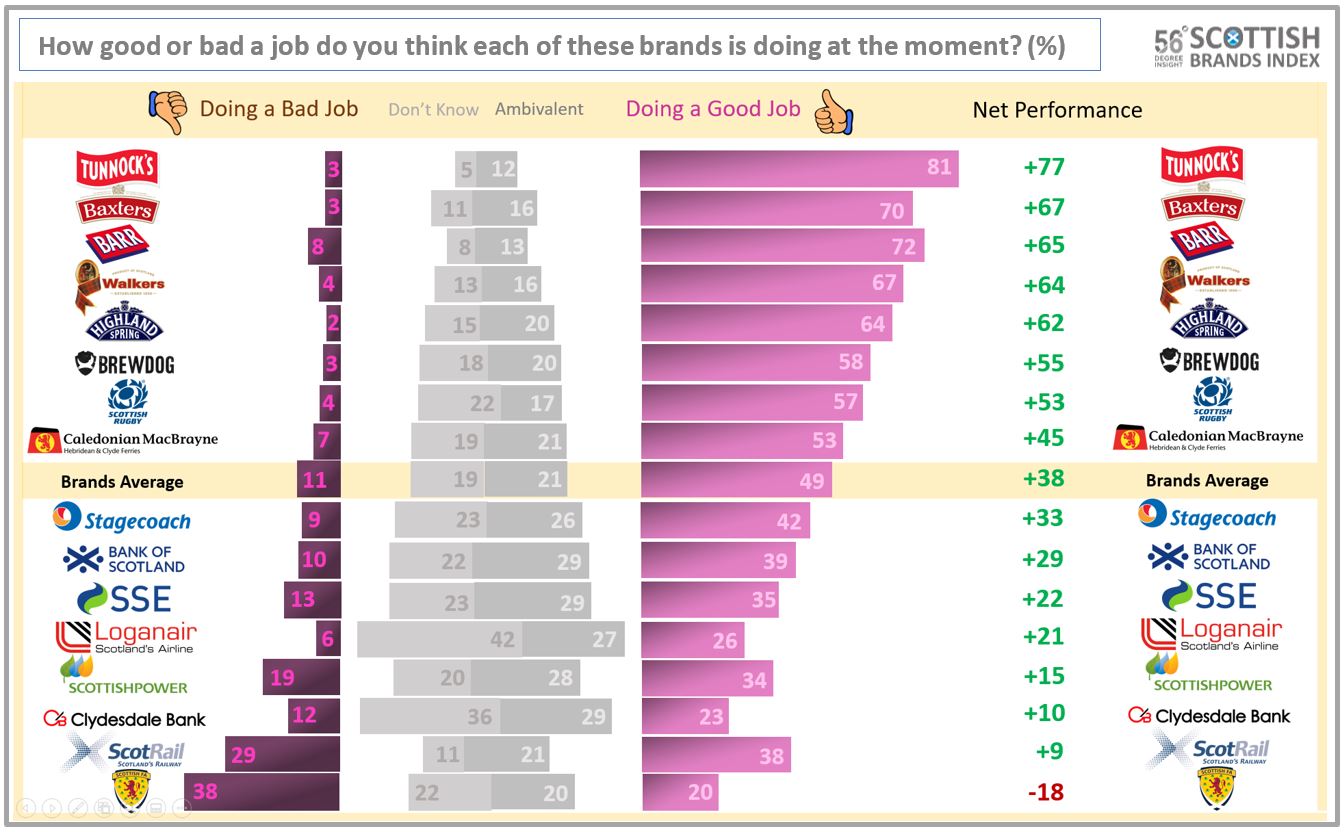

Encouragingly, the majority of our brands are perceived to be performing well. Seven of them have ‘Net Performance Ratings’ of +53 or above. Tunnocks is the undoubted hero brand in this analysis: 81% believe it is doing a good job and only 3% believe it is doing a bad job – a net score of +77, some 10 points ahead of the second best performing brand, Baxters (+67). This brand also only has 3% believing it is doing a bad job, but much higher proportions who simply don’t know (11%) or are ambivalent (16%).

AG Barr, the third best performing brand in terms of Net Performance actually has a higher proportion believing they are doing a good job than than Baxters (72%), however there is a greater degree of polarisation with 8% believing the brand is doing a bad job.

As can be seen in the chart, at the other end of the scale, there are several brands where the ratio of good to bad job is much less positive. Obviously we need to highlight the Scottish FA in particular: almost twice as many Scots believe the football governing body is doing a bad job (38%) as think it’s doing a good job (20%) – and as a result, this is the only brand under review to have a net Performance score that is negative (-18). Again, this is in stark contrast to the Scottish FA’s obvious direct competitors in our survey – the Scottish Rugby Union is doing considerably better in the minds of Scots (+53).

Other brands are also performing relatively poorly however: Scotrail, reflecting recent problems with cancellations, rolling stock issues and general delays, has a net score that is only slightly positive (+9) – three in ten Scots believe they are doing a bad job (29%) whilst just under four in ten believe they are doing a good job (38%). Clydesdale Bank also suffers from polarisation – whilst 23% believe they are doing a good job, 12% believe they are doing a bad job. And a similar picture is evident for Scottish Power where one in three believe they are performing well (34%), but one in five believe they are performing poorly (19%).

Clearly, these brands mentioned above – and several others just ahead of them in the Performance league table – are struggling to convince the Scottish public on their performance. As the quote below from Hal Geneen, the former President of the ITT Corporation in the United States illustrates, actions do speak louder than words – and these brands clearly need to address some fundamental operational concerns as perceived by the Scottish public, if their performance ratings are to be improved.

Increasing the connection and involvement with the brand

As can be seen in the chart above, for many of the brands, there are large proportions of Scots who do not have an opinion or are ambivalent to the job being done. This ranges from 17% of Scots in the case of Tunnocks to 69% in the case of Loganair – and all of these people are aware and recognise the brand. In these cases therefore, this suggests a lack of connection and involvement with the brand.

To understand this better, let’s take a step back and consider what we mean by connection and involvement. It varies considerably by the nature of the interaction with the brand. For example, in a purchasing scenario, when the decision involves a low-cost item that is frequently bought—such as bread or toothpaste—the buying process is typically quick and routinised. Buying a new car is quite different. The extent to which a decision is considered complex or simple depends on the following:

Whether the decision is novel or routine

The extent of the customers’ involvement with the decision

High-involvement brands are those that are important to the consumer. They are often closely tied to the consumer in an emotional sense. They care about them or the wider context (e.g. a governing body for a sport they care about, or a brand that they have invested in financially, buying products over many years – Apple or Samsung in the technology world for example). When it comes to a purchase decision, a buyer is likely to have gathered extensive information from multiple sources, evaluated many alternatives, and invested substantial effort in making the best decision – often sub-consciously, and built up over many years.

Low-involvement brands are often found in sectors where engagement levels are lower – classically utilities and often the financial services sector. In effect, these brands are not very important to the consumer – they are just there because they need to be, but have low levels of interest or engagement. In these cases, it may not be worth the consumer’s time and effort to search for exhaustive information about different brands or to consider a wide range of alternatives. In a low-involvement purchase, the buyer typically does little if any information gathering, and any evaluation of alternatives is relatively simple and straightforward. Brand standout in these situations is a real challenge.

Let’s highlight a few of our brands to unearth what may be happening there. Firstly, Loganair: the biggest proportion of Scots, aware of the brand, simply did not know how good or bad a job they were doing (42%) – reflecting the relatively small footprint the brand has in terms of air travel. This is also the case for Clydesdale Bank – 36% did not know – reflecting the fact that if you are not a customer or user of that bank, they found it difficult to rate them. In the same sector, only 22% were unable to comment on Bank of Scotland – perhaps reflecting the fact they are a bigger brand and more likely to have been experienced or indeed talked about by friends or family to form opinions.

Those saying they ‘don’t know’ and were unable to comment on each brand are essentially an extension of that group of consumers who did not recognise the brand at all. Although they have at least heard of the brand, there is a further awareness building job to do for certain brands which, though recognised, little is known about.

The ambivalence scores are more of a proxy for involvement and connection with each brand. High scores tend to reflect the views of people who care less about the brand or sector in question or simply have less of a connection with the brand.

In our survey, those brands with lower ambivalence scores are the ones where connection and engagement is highest - Tunnocks, AG Barr, Baxters, Walkers and the Scottish Rugby Union. In each case, Scots are more likely to have an opinion – and are generally positive. Perhaps most surprising is the good performance associated with the SRU, a governing body as opposed to a product manufacturer. Clearly, they have been extremely successful in generating interest in Scottish rugby among the general population.

The highest levels of ambivalence were reserved for the two energy brands (SSE and Scottish Power) and the two bank brands (Bank of Scotland and Clydesdale). They operate in very much ‘low engagement sectors’ where brands have a real challenge to stand out and generate interest and involvement. But, in both sectors, we have seen brands have some success in that regard:

Monzo, the online, mobile-only Internet bank have been hugely successful in disrupting the financial services sector in novel ways. They have focused on meeting the customer needs that existed and were not being satisfied by the traditional players, by being innovative, agile and responsive to customer trends, and with a stated aim that was all about ‘delighting’ its customers. Monzo looks to provide an ‘awesome’ experience and solve problems their customers do not even know they have. By doing so, they have built a loyal and engaged customer base. So, some lessons for Clydesdale Bank and Bank of Scotland – it is indeed possible to increase engagement in this sector.

And in the energy sector, although low levels of consumer engagement are the norm (the average person in the UK spends less than 6 minutes per year thinking about their energy bill), companies such as Octopus Energy, Ebico, and Tonik Energy have disrupted the sector in recent years by providing high standards in customer service and complaints handling, billing accuracy and value for money. They have left the ‘Big Six’ behind in so many ways by being more transparent, offering better perceived value for money and providing modern and effective complaints handling procedures. So, for Scottish Power and SSE to improve their brand performance scores, there is a lot of serious work to be done – though the good news is that it IS clearly possible to do so!

For companies operating in low engagement sectors such as utilities and finance, perhaps there is also an opportunity for individual brands to differentiate themselves from competitors through dialling up the emotional needs for their products within marketing activities. For example, those of us old enough will recall the television advertisements for Nestle’s Gold Blend coffee from the late 1980s and early 1990s. The serialised tale of Tony and Sharon, two characters who bond over their mutual love for Nescafé instant coffee, was a game-changer for the company and the wider advertising community. This helped to deliver 50% increases in sales in the UK as the emotional hook provided by the ads helped to generate a real consumer desire for what was, frankly, an unremarkable product – instant coffee! It does illustrate that if an emotional connection can be generated, there is potential for any brand to gain an advantage over the competition.

In conclusion……

It is incredible how just a couple of questions asked about our 16 brands can generate so much data and information on our brands. Clearly, this helps segment them into a few key categories:

Brands who need to focus on general awareness building and brand recognition: BrewDog, Loganair and Caledonian MacBrayne in particular – while SSE clearly still has an identification issue reflecting its complex heritage;

Those who are well recognised and which have high levels of perceived performance – Tunnocks, Baxters, Walkers, AG Barr, Highland Spring and the SRU all do particularly well in this regard – as does BrewDog among those aware of the brand. Strategies to maintain and enhance these perceptions should be pursued;

Brands with poor net performance: the Scottish FA in particular, but also Scotrail, Clydesdale Bank and Scottish Power have significant, negative public perceptions to address;

Brands where ambivalence is high – and engagement and connection is low: the two financial services providers, Bank of Scotland and Clydesdale Bank and the two energy providers, Scottish Power and SSE each have high levels of indifference. They need to develop strategies around customer experience and performance which help them to stand out in a positive manner – and perhaps develop emotional hooks within their advertising activities.

But of course, brand strength is not just about recognition, engagement and performance. Being ahead of the curve is vital – and next week, we focus on the extent to which each of our brands are future-focused and ready to perform in an ever-changing environment.